proposed estate tax changes october 2021

The TCJA doubled the gift and estate tax exemption to 10 million through 2025. The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the amount of the Lifetime Exemption.

21 Unique Vacation Spots For Your Summer Trip In 2022 Extra Space Storage Unique Vacations Vacation Vacation Trips

The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax.

. Current Transfer Tax Laws. If the trust later sells the property for 110000 the trust can offset the gain with the 30000 previously disallowed loss and only pay tax on a 10000 gain as though its basis. During your planning and discussions please consider that legislative proposals.

2026 there also are tax proposals in play that could change the estate and gift tax laws much sooner. Tax payments checks only. The 117M per person gift and estate tax exemption will remain in place and will be increased.

The House budget reconciliation bill HR. Would also like to substantially increase. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

This article details proposed changes that are current at the time of publication. October 22 2021. 5376 contains proposed changes that.

For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. Current Law in 2021. 27 October 2021.

Reduce the current 11700000 per person gift and estate tax exemption the unified exemption by approximately one half. July 13 2021. The Biden Administration has proposed significant changes to the.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The Biden campaign is proposing to reduce the estate tax exemption to. Fire Prevention Home Safety.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Administration has proposed to tax capital gains when transferred by gift or at death. The current 2021 gift and estate tax exemption is 117 million for each US.

Estate gift and GST tax exemptions will remain at 117 million with increases. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Recent Changes in the Estate and Gift Tax Provisions Updated October 19 2021.

The federal gift estate and generation-skipping transfer GST tax exemptions that is the amount an individual can transfer free of any of. This marginal rate would apply to. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

That is only four years away and. 455 Hoes Lane Piscataway NJ 08854 Phone. The proposed change.

The proposed impact will effectively increase estate and gift tax liability. The proposed bill would increase the top marginal individual income tax rate to 396 effective after December 31 2021. To pay your sewer bill on line click here.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The House of Representatives Committee on Ways and Means recently proposed a new tax plan. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Fire Inspections Safety Permits. That amount is annually adjusted for inflation for 2021 its 117 million. No Changes to the Current Gift and Estate Exemption Provisions Until 2025.

This proposal if enacted will. No cash may be dropped off at any time in a box located at the front door of Town Hall. Grantor Trusts Grantor trusts trusts whose taxable activity.

The Biden Administration has proposed sweeping estate tax impacts to the estate and gift structure. Estate gift and GST tax exemptions will remain at 117 million with increases allowed for inflation in 2022-2025.

Taxtips Ca 2021 Sales Tax Rates Pst Gst Hst

The Big Longs Of The Big Short Hero The Big Short Michael Burry Company Values

168 Major Change Of Plans Youtube Pch Road Trip Oregon Travel Road Trip

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

12 Cognitive Biases That Hurt Our Finances Finance Infographic Cognitive Bias Finance

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

Managing Your Personal Taxes 2021 22 A Canadian Perspective Ey Canada

Faux Columns Decorative Columns Driveway Design Stone Driveway

Axis Ecorp Forays Into Commercial Plots Segment For Tourism Holiday With Launch Of Axis Lake City Tourism Lake City Lake

Tax Updates Rr 17 2021 Extension Of Estate Tax Amnesty Rmc 94 2021 And Rmc 97 2021 Estate Tax Social Media Influencer Social Media

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Canadian Tax Return Deadlines Stern Cohen

Severe Weather In 2021 Caused 2 1 Billion In Insured Damage

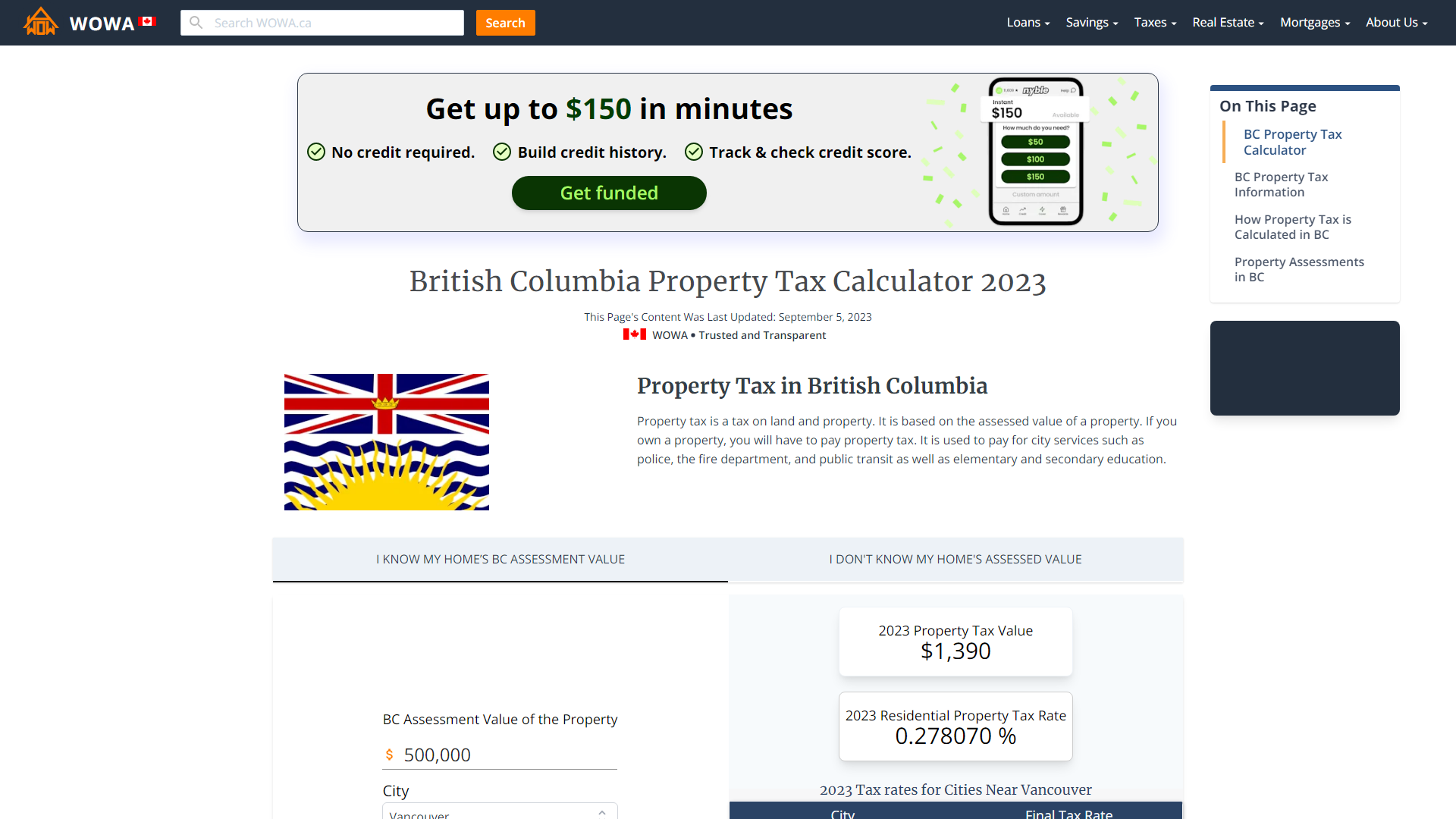

British Columbia Property Tax Rates Calculator Wowa Ca

Free Download Pdf Schism China America And The Fracturing Of The Global Trading System Free Epub Mobi Ebooks Free Kindle Books Ebook Free Ebooks

Personal Income Tax Guide The Deadline For Filing Your 2021 Return Tax Brackets And More Moneysense